BY: JULIA RENAUD

BIST’s April Community Meeting featured guest speaker Jason Peddle, Vulnerable Persons Coordinator at the Toronto Police Services who spoke about protecting yourself from scams and phishing.

About Jason Peddle:

- With a background in Kinesiology, Social Work, and Dementia Studies, Jason has worked as a Therapeutic Recreationalist in nursing homes and as a Family Support Worker at the Alzheimer Society.

- He switched vocations in 2006, and for 10 years worked as a Police Officer in various roles, including front-line policing.

- As his career progressed, his interest in Community Focused Policing led to his appointment as Toronto Police Service’s Vulnerable Persons Coordinator, a role h he has done for three years.

What to know about scams:

- Anyone and everyone can be a target of a scam

- The goal of the scammer is to get your money now OR

- Get your personal information to use to get your money later!

The 5 Hallmarks of a Scam

1. Unsolicited

They came to you without your request, such as by phone call, e-mail, door knocking etc.

2. Urgency

They want you to do something right away or else, such as ‘pay now or you will get arrested!’

3. This is routine

If you question them, they will assure you that what they are doing is completely normal. They talk quickly and give a lot of information so there is less time to process it. They will try to convince you that if you question them, you are in the wrong, such as ‘I have checked all of your neighbours’ water heaters; your neighbourhood seems to have particularly bad water heaters.’

4. High Reward & Low Risk.

Pay attention to your gut! If something seems too good to be true, it probably is. The potential reward for these criminals is high for very little risk.

5. Payment Up Front.

They want the money right away, not later.

How to Avoid Becoming a Victim

- Follow up with contact info that you find yourself.

Don’t rely on the text displayed on your caller ID, even if it says your bank’s name; fraudsters can change the caller info that comes up on your phone! Yikes!

2. Don’t rush decisions / do your homework.

If someone threatens you with a time limit, it’s a fraud.

3. Don’t let people into your home.

Stand your ground, it’s your home and you have the right to say who comes in and who doesn’t.

4. Don’t share personal information, no matter how meaningless it may seem.

If the person is legitimate, they won’t mind your precaution.

Scam artists are sneaky

They look like you and me – often they look professional and have impressive offices/addresses and they are very good at what they do!

Examples of Common and Current Scams

- Someone claiming they are from the Canada Revenue Agency contacts you asking you to pay your taxes right away.

This is the most common scam every year because people keep falling for it.

2. Emergency

Someone calls pretending to be someone they aren’t saying there is some kind of emergency and you need to respond quickly. This is also called the “grandparent scam” as the elderly are often targeted.

3. Advance Fee

You’ve won a prize but need to send money in advance.

4. Misleading Prize Offer

You win the lottery or a prize for a contest you didn’t enter.

5. Romance

This is the most profitable scam and can happen online or in person. Someone pretends to fall in love with you; then they ask for money, often more than once.

6. Non-Existent Charity

Someone asks you to donate money to charity using a recent, real life tragedy to make them sound credible. If you want to donate, reach out to the charity of your choosing using contact information from a reputable source.

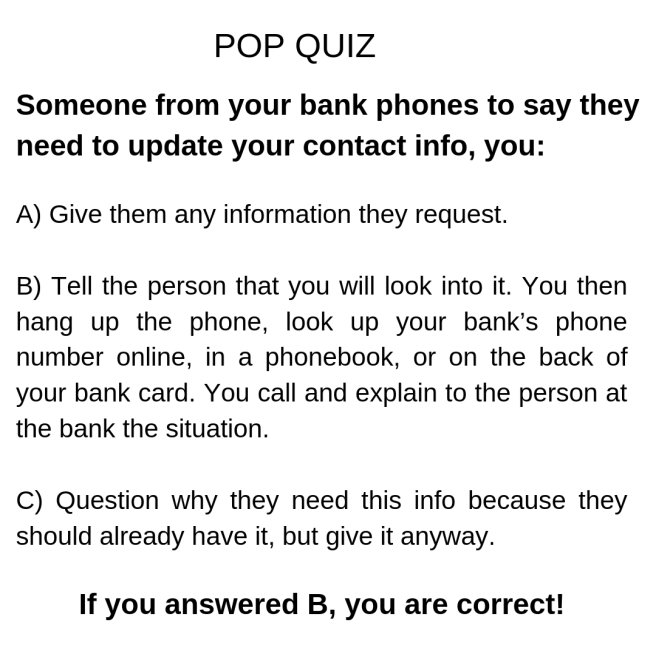

7. Account Info Update

Someone contacts you to update your information.

8. Online Purchase

You as the seller: an interested buyer (intentionally) overpays. The buyer claims they made an error & asks you to send back the difference using an untraceable method (i.e. wire transfer). The payment ends up being fake and you lost your money.

You as the buyer: you don’t receive the item(s) you paid for.

9. Door to Door

Someone claims they need to enter your home to check or service something that you had not arranged (i.e. furnace, water heater, duct cleaning service, etc.).

Many types of door-to-door sales are now illegal.

Know about your rights regarding door-to-door sales and home service contracts, read more about Ontario’s regulations concerning door-to-door sales, HERE.

Phishing

Phishing happens when cyber criminals trick you into giving information. When you respond, they get access of your accounts or download ‘malware’ to your computer. Here are some tips to prevent being a victim of phishing: And importantly, if you receive an e-mail you don’t trust, delete it without opening it!

Phishing Scam Examples:

- The Email Scam

Clues that it’s a scam:

- The spelling of the sender’s address doesn’t make sense.

- Generic/non-personalized greeting.

- A link to click on.

- Careful, the listed link isn’t always the actual link!

- Hover your cursor over the link beforeclicking it to make sure the links match; if they don’t, don’t click on it!

2. The CRA Scam

Clues that it’s a scam:

- Generic/non-personalized greeting.

- The dollar sign is on the wrong side of the numbers.

- A link to click.

- Clicking it could cause malware to be downloaded onto your computer. Uh oh!

How to Tell If you’ve been a Victim of a Scam:

- You notice unexpected changes in your account.

- You receive credit cards you never applied for.

- You receive notice that you have been denied credit that you didn’t apply for; or, you are denied credit for no apparent reason.

- You receive correspondence from debt collectors.

- Credit report shows accounts that aren’t yours or contains inaccurate information.

- Bills or statements you still receive by mail stop coming.

- Unsolicited proposals come more often.

- This is because fraudsters sell information of victims to other fraudsters.

Who to call if you’ve been victimized

Toronto Police: 416-808-2222

Canadian Anti-Fraud Centre: 1-888-495-8501

Better Business Bureau: 519-579-3080

Check your credit with a credit bureau you trust.

Julia Renaud is a very talkative ABI survivor with a passion for learning new things, trying new activities, and meeting new people – all of which have led her to writing this column. When not chatting someone’s ear off, Julia can be found outside walking her dog while occasionally talking to him, of course!