Financial Abuse Toolkit

Making the connections: Dementia, Acquired Brain Injury & Financial Abuse

Living with Acquired Brain Injury (ABI) and / or dementia comes with multiple challenges which put people at increased risk for financial abuse and fraud. Symptoms such as impaired decision making, long and short term memory loss, managing emotions, poor concentration, weakened time-space orientation, impaired senses (such as hearing and vision loss) and slowed information processing increase vulnerability.

In addition, people are at an increased risk of financial exploitation if:

-

They have a cognitive impairment, such as ABI, Dementia or Mild Cognitive Impairment

-

Their spouse has recently died

-

They live alone

-

They are in poor health

Through educational sessions, volunteer training, peer support and an online toolkit, BIST aims to spread awareness and prevent Financial Abuse and Fraud to Older Adults living with cognitive impairments.

For more information on education sessions, please contact BIST at: info@bist.ca or 416-830-1485.

Funded by:

Explore Our Online Toolkit:

Financial Abuse: Spot It and Stop It

Financial Abuse and Fraud are different types of financial misconduct. Regardless of how they happen, both involve someone taking your money and / or property. It is important to learn how to recognize and protect yourself against all forms of financial abuse and misconduct.

Financial Abuse

Financial abuse is when a person you trust violates that trust and gains financially at your expense. Financial abuse is the most common form of abuse against older adults and is the fastest growing form of abuse against adults with disabilities. According to Elder Abuse Ontario, financial abuse is most often committed by a person the abused person knows, in particular; family members, friends and associates.

Research indicates financial abuse against older adults (ages 60 and up) and people with disabilities (including brain injury), is a growing problem:

-

4%, or 60,000, older adults in Ontario report being a victim of elder abuse, and more than 60% or 36,000 of these cases involve financial misconduct.

(Ontario Human Rights Commission) -

It is estimated that only 1 in 5 victims report abuse, making these numbers a lot higher.

-

Globally, the World Health Organization (WHO) reports that 19% of seniors have experienced financial or psychological abuse. The WHO also purposes that only 1 in 24 cases are reported, suggesting staggering numbers worldwide.

-

Statistics about financial abuse of people who live with cognitive impairments, such as Acquired Brain Injury, are hard to come by because the majority of this abuse is hidden and never reported

Financial abuse can happen anywhere:

-

In your home

-

In a seniors’ residence or long term care facility

-

In a hospital

Financial abuse can be VERY OBVIOUS or VERY HARD to spot.

More OBVIOUS examples of FINANCE ABUSE are:

-

Stealing money from your wallet

-

Cashing a cheque in your name and keeping the money

-

Stealing expensive items from your home

-

Stealing your identity to access your bank account, credit card etc.

HARD TO SPOT examples of FINANCIAL ABUSE are:

-

When someone claims to want to “help” with the grocery shopping and asks to use your debit or credit card to buy groceries – but they use your card for their own purposes

-

When someone pressures you to hand over expensive items that are yours. For example, “I could help you more if I could have your car.”

-

When someone pressures you to buy them expensive items. For example, “My fridge is broken, and I can’t afford to buy a new one, if only someone could loan me the money.”

-

When someone lives with you and does not contribute to household expenses

-

If they are your Power of Attorney, and are not letting you access your own money

-

Feeling pressured to sign documents when you don’t understand them

Single instances of financial abuse are very rare, financial abuse most often occurs in patterns which are repeated over time. A person can be tricked into signing papers or giving away their financial information.They may feel pressured to do what their abuser asks because they need them for practical help and / or companionship and don’t want to lose the relationship.

If you think you are being abused, help is available. Call your local Police Department and see our Resources page for more information.

In Toronto call the Police at: 416-808-2222.

Risk Factors

While financial abuse can happen to anyone, at any time, there are certain periods in a person’s life when they are more likely to be exploited. Unfortunately, this usually happens when a person has been through a difficult life transition and are more vulnerable. It is also more likely to happen to people who are socially isolated, and who have health conditions which make them more dependant on others.

You are at a higher risk of being abused financially:

-

If you are an older adult

-

If you live alone

-

If your spouse has recently died

-

After a health crisis or if you are in poor health

-

If you live with a cognitive issue, such as Acquired Brain Injury (ABI), or age-related Cognitive Impairment

There are many forms of abuse. Unfortunately, it is not uncommon for a person to experience multiple kinds of abuse at the same time. Other types of abuse are:

-

Psychological Abuse – words and/or actions meant to frighten, control or isolate you

-

Sexual Abuse – non-consensual unwanted sexual touching and / or activity

-

Physical Abuse – any bodily contact with force, intended to harm

-

Neglect – when your required needs go ignored, this can include failure to assist with feeding, bathing, etc.

-

Medical Abuse – someone preventing you from seeking medical treatment

-

Medication Abuse – someone withholding medication from you

If you think you or someone you know is being abused, there is help available. Call your local Police Department and see our Resources for more information.

In Toronto call the Police at: 416-808-2222.

The article, ‘Starting over: How to rebuild your finances after experiencing financial abuse’, links to resources in the U.S, but offers useful information about how to rebuild your finances after being financially abused. Read it, HERE.

Fraud: Spot It and Stop It

What is fraud?

Fraud is when someone deceives you into handing over money, property or your personal information for their own gain.

It is a crime to commit fraud.

People who commit fraud have one of two goals:

Get your MONEY NOW

Get your PERSONAL INFORMATION NOW so they can get your money LATER

Anyone can be a victim of a fraud or a scam.

If you think this has happened to you, you are not alone. In 2018 the Better Business Bureau reported that Canadians lost $121 million to scams. It is estimated that only 5% of scams get reported to the police, so this number is a lot higher.

If you think you have been a victim of a fraud report it to your local police department or the Canadian Anti-Fraud Centre at:

1-888-495-8501.

Visit our resources information for where to get help, HERE.

BIST has created some helpful stickers and magnets to help remember these tips when dealing with a potential scammer.

To download or order some click HERE.

These are the Top 3 Signs Someone is Trying to Scam You

#1. You are being PRESSURED or THREATENED

Scammers will often threaten or pressure you into handing over your credit card, money or other personal information. They may tell you the police are on their way to arrest you if you don’t give out information immediately. They may tell you there is a service you need (for example, claiming your roof needs fixing) and say you need to pay a large deposit in order to secure the deal that day. Legitimate business people or government workers will not pressure you or threaten you to pay money or give your credit card or any other information. Being pressured or threatened is a common sign that someone is trying to scam you.

#2. Someone comes to your DOOR UNEXPECTEDLY, trying to sell you a service they claim you need

Most door-to-door sales are illegal in Ontario. People who come to your door to try and sell you a service or product are likely scammers. Do not let them in your home. Shut the door and do not talk to them. If they are legitimate they will allow you to contact their employer to verify their information. If a salesperson is in your home and will not leave, or makes you feel uncomfortable, call the police.

#3. They want your PERSONAL INFORMATION

Scammers can access your identity using personal information and use it to get things like credit cards in your name. This is identity theft, and it is a serious crime.

Examples of PERSONAL INFORMATION you SHOULD NOT GIVE OUT include:

-

Where you were born

-

When you were born (your date of birth)

-

Bank account or credit card numbers

-

Bank account or credit card numbers

-

Your Internet passwords

-

Your mother’s maiden name

-

Your driver’s license

You can find out more about identity theft and how to protect yourself from it, HERE

Scams can happen anywhere at any time, but are most common over the phone, the Internet and when someone comes to your door. Here are examples of how to recognize all three types.

Phone Scams:

Phone scams are a common type of fraud. While there are many types of phone scams, some are more common than others. When it comes to protecting yourself from a phone scam, remember legitimate callers will NOT:

-

Pressure you to hand over your credit card or driver’s license information

-

Make threats against you if you don’t do what they say, such as “the police are on their way right now to arrest you” or “you’ll be charged a penalty fee”

The ONLY WAY you can confirm you are getting a call from a legitimate source is to call the Government Office or company back YOURSELF.

You need to use a phone number you have found on your own. Do not trust the phone number a caller gives you.

Do a Google Search to find the right number, or call 211 to get contact information on government and community services. 211 is open 24 hours a day, 7 days a week and is a free community information service. Simply dial 211 on your phone.

Here are common Phone Scams:

Canada Revenue Agency (CRA) Scam

How it happens: You receive a call from someone claiming to be from the Canada Revenue Agency (CRA). They tell you that you owe tax money and the police are coming to arrest you if you don’t hand over your credit card information or do what they say immediately. The Government of Canada has information on how to protect yourself from CRA scams, HERE.

If you receive a call from someone claiming to be from the CRA or another government agency, the Government of Canada recommends that you:

- Write down the caller’s name, work section and office location. Tell them you want to verify their identity before going any further. Legitimate government workers will respect and respond to this request. If they don’t, hang up.

-

If the caller gives you this information, call the CRA at 1-800-959-8281 to find out if the person calling is an employee calling with a legitimate issue.

-

Call 211 to confirm government agencies and contact information.

Different versions of this scam may be from someone claiming they are from your bank or insurance company, saying you owe money or offering you a special deal or rate. They want you to give them your personal information such as your credit card or driver’s license immediately. If this happens: take down the caller’s information and call the place back with a number you have found yourself and you know is legitimate.

Remember, if you are being pressured or threatened to hand over money or personal information, it is likely a scam. Hang up the phone. Unsure? Call the Canadian Anti-Fraud Centre 1-888-495-8501.

Grandparent or Emergency Scam

How it happens: You receive a call or email from someone who says they are a relative who is in trouble and needs money immediately. They could be pretending to be a sick grandchild, or another close relative. Remember that scammers want to access your money or information immediately, and pressure tactics are very common. If the call has these elements, it is likely a scam.

Charity Scam

How it happens: You receive a call or email asking to donate to a specific cause. These are very common during a humanitarian disaster (such as a war, or earthquake). Donating is a good thing, BUT you need to be sure your money is going to the right place and not a fraudster. If you want to make a donation, find out which charities are legitimate by calling 211. After a natural disaster, 211 and many media organizations will list legitimate places to donate to. You can also look up registered charities on the Government of Canada’s website, HERE.

Advance Fee for a Prize

How it Happens: You receive a phone call or an email stating you have won a prize, but you need to pay a fee in order to collect the prize. Legitimate prizes do not require a fee to claim them. Also, you can not win a prize if you have not entered a contest.

Investment Scams and Pyramid Schemes

How it Happens: You are told about an investment opportunity that offers a great return on a short term investment. Or you are offered a chance to pay to join a money making venture. You make money by getting other people to join the venture. This latter is called a pyramid scheme and it is illegal in Canada. There are many legitimate opportunities where you can invest money. The RCMP suggests the following tips to prevent investment scams:

Prevention tips:

- If you are feeling pressured to join an investment opportunity at a business meeting, it is likely a scam. Remember pressure and threats are a common factor in scams.

-

Do your homework, check with the Ontario Securities Commission to find out about your investment advisor.

-

Be cautious if you are being asked to wire a large amount of money to another country.

-

If the opportunity sounds too good to be true with a higher return than normal it is likely a scam.

RESOURCE: Do Not Call List

To reduce the number of telemarketing calls you receive, you can register for the National Do Not Call List. This is a free service and your phone number will stay on it indefinitely.

There are many ways you can register:

-

Online: www.LNNTE-DNCL.gc.ca

-

Call: 1-866-580- DNCL (3625)

-

TTY device: 1-888-362-5889

-

Fax: 1-888-362-5329

Door-to-Door Scams

Door-to-door scams are another type of fraud. Never let someone who comes to your door unexpectedly into your home. Most door-to-door sales are illegal in Ontario. Some scammers may call you first to get you to invite them into your home at a later date. You can call the police if a sales person in your home is making you feel uncomfortable. In Ontario, the following products are NOT ALLOWED to be sold door-to-door. This means it is illegal for someone to come to your door and try to sell you:

-

furnaces

-

air conditioners

-

air cleaners

-

air purifiers

-

water heaters

-

water treatment devices

-

water purifiers

-

water filters

-

water softeners

-

duct cleaning services

-

any good or service that performs or combines one or more of the above functions

If you called a contractor to do a service such as a repair, they can not enter into a new contract with you at this appointment. They can only leave you information on their products and services.This means, if you called a furnace repair person, they can not sell you other services while they are in your home to do that repair. They can leave information about their other services, and you can choose to purchase them at another time, or not.

Information on Service Contracts:

If you sign a service contract, you have the right to cancel it without reason within a 10-day period. In addition, a consumer contract MUST include specific information about the goods and services you are buying and your rights as a consumer. If the contract does not have this information, you can cancel the agreement within one year of signing the contract. The Government of Ontario has more information on cancelling a contract and knowing your rights as a consumer, HERE

Here are common Door-to-Door Scams:

Water Quality Testing

How it Happens: A sales person comes to your door, claiming that your house has been flagged by the city for water quality testing. They want to enter your home to test the water quality. They may also claim to be coming for their annual check on your thermostat. Do not let them into your home. If a salesperson comes into your house, and refuses to leave or makes you feel uncomfortable, call the police.

Driveway Paving or Roof Repair

How it Happens: A scammer comes to your door stating they have a special offer for today only. They pressure you to sign up for the offer immediately, and require a large deposit. Often these scammers do not show up to do the work at all or do such a poor job you need to pay someone else to do it over again. Remember, scammers will use pressure tactics to get your money right away. Legitimate sales people will not pressure you to pay money immediately. One way to find out about legitimate businesses is through the Better Business Bureau: 1 (800) 459-8875.

Online Scams

Scams in the online world are thriving. Usually they happen by tricking you into clicking on a link in an email or pop-up window, which installs software on your computer allowing scammers to access your personal information. This can also happen when someone tricks you into spending money or handing over personal information.

Malicious software (Malware)

Scammers can install malware on your computer by getting you to click on a link in an email or pop-up window or by tricking you into visiting a website, which installs software on your computer. This software then lets scammers access your personal information such as passwords, and can give them total control over your computer, including access to your camera. Other names for malware include spyware, Trojan horses or Trojans.

Phishing

Phishing is when scammers trick you into handing over your personal information such as your bank account. Some common clues an email is from a scammer are:

-

Look closely at the spelling of the sender’s address. If it looks strange or has a typo, it is likely a scam.

-

There is a generic greeting (not personalized)

-

They want you to click on a link. Be careful: the link that’s shown isn’t necessarily the right link. To make sure the links match, hover over it to make sure it matches. Don’t click on it!

-

The dollar sign is on the wrong side of the numbers.

The top rule here is if it looks suspicious, delete the email. Do not reply to the email and do not click on any links!

There are many kinds of Spam Emails

Here are some examples of Spam Emails from scammers. Notice what they have in common:

-

They may have spelling, punctuation and grammar mistakes (though in some cases, the email may be well written)

-

The greeting is usually generic and not addressed to you personally

-

They want you to click on a link. Hovering over the link indicates that you will be directed to a different website than claimed

-

Similar to other scams, they pressure you to act immediately, usually with a threat (such as account cancellation)

-

Remember, as with all scams, the goal of spam emails is:

-

To get your MONEY NOW

-

To get your PERSONAL INFORMATION NOW so they can get your MONEY LATER

The Scam: Verify Your Identity

In this example, the signs of the scam are marked in red.

The scammer is posing as Amazon. They claim your account has been taken over by another individual, and that you must verify your account information in 36 hours by clicking on a link. They state if you fail to do so, they will terminate your account.

How to tell it’s a scam:

-

Look at the sender – Amazon is spelt incorrectly

-

There are spelling mistakes in the message

-

The email is not addressed to you personally, it has a generic greeting

-

The scammer wants you to reply immediately

-

When you scroll over the link to confirm your identity, you can see that it will re-route you to a non-Amazon link

The Scam: Fake Account Cancellation

The scammer is posing as an admin for an account they claim you have. They claim someone has requested to shut down your account and they want you to click on a link to confirm this request.

How to tell it’s a scam:

-

It has a generic greeting

-

It is unclear where the account is from (bank, credit card etc.)

-

There are grammar and punctuation mistakes

-

Hovering above the link shows a different link than the email specifies, which will likely install malware onto your computer that will allow for the scammer to access your personal information.

The Scam: Fake Bank Account

The scammer is posing as RBC Bank. The email states you need to add new security features to your account by clicking on the link.

-

The message is not from an RBC Royal Bank email address

-

There are several punctuation and grammar errors in the email, and the language is awkward

-

When hovering over the link, it will re-route you to a non-RBC Royal Bank link which will likely install malware on your computer

-

If you receive an email similar to this from an institution you know you have an account with, and you are unsure if the email is legitimate, call the bank via the number on the back of your bank card. Do not use a phone number provided in the email

-

If you do not have an account with this institution, you know for sure this is a spam email

The Scam: Locked out of your Account

The scammer is posing as Rackspace. They claim they have blocked your access to their site in order to help ensure your account security. They state if you wish to unlock your account, you must click on the link provided to verify your account information.

How to tell it’s a scam:

-

The message is not from a Rackspace email address

-

The sender wants you to click on a link, and threatens account suspension if you fail to do so

-

The link will likely take you to a site which will download malware on your computer

The Scam: Fake Account

This is another scammer posing as a Rackspace account. This email is more professionally designed but is still a scam.

How to tell it’s a scam:

-

If you read the email carefully, there are many grammar errors and the language is awkward

-

Scrolling over the link shows it is not linked to Rackspace and will likely take you to a malicious site

How the Scammer is trying to make this email look legitimate:

This is the same email, with different scam indicators noted.

-

Notice the recipient’s email application has marked the email as Suspected Spam.

-

The email is not from Rackspace, and the scammer is apparently using an address from the same account as the recipient (in this case, bist.ca)

-

It is likely that every person who receives a message from this scammer will see an email with a similar account name (for example, if your email address is with @yahoo.ca, the sender will appear to be from @yahoo.ca)

-

The footer says emails sent to the account will not be replied, this is an attempt to force the recipient to click on the link

The Scam: Fake Compensation from a Fake Scam

This is a scammer posing as a someone compensating victims of previous scams! It’s a double whammy!

How to tell it’s a scam:

-

If you read the email carefully, there are many grammar errors and the language is awkward, including the salutation “Attention Dear”

-

They are looking for all your personal information, including your “Identity Card” which is ambiguous

-

The email address is a hotmail account and not from a legitimate financial institution

Internet Scams

Here are tips for making safe online purchases:

-

Become familiar with the website you are using. Their contact information should be easily available and include: the business name, address, phone number and email address. It is better to deal with businesses that are located in Ontario, when possible.

-

Before you buy, be sure you know the full cost, including taxes, shipping and handling and duties.

-

When you enter your credit card information online, be sure it is on a protected server. For more information on how to tell if a website is secure, see below.

-

Read customer reviews of the product and the company before you purchase the item. Print or save all receipts, invoices and agreements related to your purchase.

-

Never enter your credit card information in a pop up message that comes on your screen. Real businesses do not do transactions this way.

-

Do not use public WiFi, such as at the Public Library or at a coffee shop, to buy online as these networks are not secure.

How to tell if a website is using a protected server:

-

Check the status bar. The website should begin with https://

-

Check to see if the site has an EVSSL certificate, this will appear with a coloured company logo next to the address:

-

Check to see if there is a padlock icon in the status bar:

The Government of Canada has a video about how to tell if a website is secure:

Here are common Internet Scams. They can also happen in other ways (such as over the Phone).

Romance or Catfishing

How it Happens: This is the most profitable scam and it can happen online or in person. It happens when you meet someone online and they claim to fall in love with you. In the United States in 2018, people reported losing $143 million to romance scams — a higher total than for any other type of scam reported to the FTC. The median reported loss was $2,600, and, for people over 70, it was $10,000.

Signs your romantic interest is really a scammer include:

-

They get in some kind of trouble and need you to send them money. Often this happens more than once

-

Their photo looks like it may be a stock photo

-

They don’t live in the same country as you

W5 produced a series about the ‘Big Business of Romance Fraud’, which you can watch, HERE

Advance Fee for a Prize

How it Happens: You receive a phone call or an email stating you have won a prize, but you need to pay a fee in order to collect the prize. Legitimate prizes do not require a fee to claim them. Also, you can not win a prize if you have not entered a contest.

Sextortion

How it Happens: This can happen if you visit an adult-themed website. If the website has malware (malicious software) on it, it is possible a scammer can access your computer and all the information (such as passwords and account information) stored on your computer as well. At times, they can even access the camera on your computer to record you while you are on your computer. The scammer then uses the fact they have access to your images and passwords to extort money from you in exchange for them.The best way to avoid malware or viruses from getting on your computer is to install anti-malware or anti-virus software on your computer. It is also common to receive an email stating that someone knows you visited a porn site and used your camera to capture you watching it. Money is requested or else the video will be turned over to your family and friends. This email is often a scam and should be deleted immediately.

Account Information Update

How it Happens: You receive an email from a bank or other company stating they need to update your account information. You may or may not have an account at the bank they are claiming to be from. Do not reply to the email or click on any links. If you think your bank may want to update your contact information, look up the number for your bank (it is on the back of your bank card) and call the bank yourself.

Online Shopping / Selling

How it Happens:

#1. Selling an Item Online:

The buyer overpays for it, by cheque. Later, they contact you and claim they overpaid in error, and ask you to send them the money back in a way that’s not traceable. You realize the original payment is a fake and you’ve lost your item and the money.

If you sell items online, make sure you have received the money you are promised immediately and don’t send any money back to a seller. It is best to receive payments by cash or by e-transfer.

#2. Buying an item online:

You purchase an item, and you do not receive what you pay for. The Government of Ontario has tips for making safe online purchases, which you can read about, HERE. Some useful tips for safe online shopping the Government of Ontario advises include:

- Become familiar with the website you are using. Their contact information should be easily available and include: the business name, address, phone number and email address. It is better to deal with businesses that are located in Ontario, when possible.

-

Read customer reviews of the product and the company before you purchase the item.

-

Print or save all receipts, invoices and agreements related to your purchase.

-

Before you buy, be sure you know the full cost, including taxes, shipping, handling and duties.

-

When you enter your credit card information online, be sure it is on a protected server. For more information on how to tell if a website is secure, see below.

-

Do not use public WiFi, such as at the Public Library or at a coffee shop, to buy online as these networks are not secure.

-

Never enter your credit card information in a pop up message that comes on your screen. Real businesses do not do transactions this way.

Investment Scams

How it Happens: You are told about an investment opportunity that offers a great return on a short term investment. Or you are offered a chance to pay to join a money making venture. You make money by getting other people to join the venture. This latter is called a pyramid scheme and it is illegal in Canada. There are many legitimate opportunities where you can invest money. The RCMP suggests the following tips to prevent investment scams:

Prevention tips:

- If you are feeling pressured to join an investment opportunity at a business meeting, it is likely a scam. Remember pressure and threats are a common factor in scams.

-

Do your homework, check with the Ontario Securities Commission to find out about your Investment advisor.

-

Be cautious if you are being asked to wire a large amount of money to another country.

-

If the opportunity sounds too good to be true with a higher return than normal it is likely a scam.

If you or someone you know is being abused or is a victim of a fraud or a scam, there are resources that can help.

24/7 Resources

Police

If you feel that you have been a victim, or someone you know may be a victim, you may call and report the incident to your local Police Station. In Toronto, call the Police at: 416-808-2222. If you are outside Toronto, call your local Police Department.

211

211 is a FREE & confidential resource to get information on Government numbers, Community Services (such as help with groceries, or community centres that offer social and recreational programs that can relieve isolation). Simply dial 2-1-1 from your phone. 211 is open 7 days a week, 24 hours a day. You can visit them online at: www.211toronto.ca.

Seniors Safety Line

You can also call the Seniors Safety Line for support and information on resources at: 1-866-299-1011. This number is open 24 hours a day, 7 days a week.

Reporting Abuse in Retirement Homes

Retirement Homes Regulatory Authority: 1-855-275-7472

Reporting Abuse in Long Term Care Homes

Ministry of Health and Long-Term Care ACTION Line: 1-866-434-0144 TTY: 1-800-387-5559

You can also call the ACTION Line with any problems, concerns, or complaints about home care services, long‑term care homes, or a LHIN.

Legal Help

There are FREE services that can offer Legal Help if you think you are a victim of financial abuse or fraud. You can also call 211 to get more information on other community legal services which may be available to you.

Advocacy Centre for the Elderly (ACE): 1-855-598-2656

ARCH Disability Law Centre: 1-866-482-2724

National Canadian Lawyer Initiative: A new initiative launched by lawyers in response to the COVID-19 Pandemic, providing 5 free hours of legal advice to anyone, regardless of income.

Power of Attorney

CLEO has created an online, clear language toolkit for CREATING or CANCELLING a Power of Attorney, HERE.

Office of the Public Guardian & Trustee: 416-314-2800 or 1-800-366-0335

If anyone believes that a senior’s money or property is at serious risk, that person may report this to the Office of Public Guardian and Trustee. The Public Guardian and Trustee is required to investigate all reports, and in serious cases, to become the senior’s guardian to help or protect them.

Information on Fraud and Scams

These organizations have regularly updated information on types of scams and fraud. You can call them or check their websites for more information.

Canadian Anti-Fraud Centre: 1-888-495-8501, Online Fraud Reporting System, HERE

Better Business Bureau: 519-579-3080

Elder Abuse Ontario: 1-866-299-1011

Government of Canada: Because of the frequency of scams from people claiming to be from the Canada Revenue Agency (CRA), the Government of Canada has created an online guide to prevent being a victim of these types of scams, HERE.

70+ Common Online Scams used by Cyber Criminals & Fraudsters via comparitech

The Canadian Competition Bureau has information on Scams available in multiple languages, HERE.

Do Not Call List

To reduce the number of telemarketing calls you receive, you can register for the National Do Not Call List. This is a free service and your phone number will stay on it indefinitely.

There are many ways you can register:

-

Online: www.LNNTE-DNCL.gc.ca

-

Call: 1 866 580- DNCL (3625)

-

TTY device: 1 888 362-5889

-

Fax: 1 888 362-5329

Anti-Fraud & Financial Abuse Resources

Funded by:

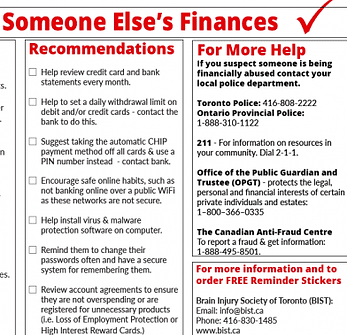

Need a reminder?

You can print reminders about the Common Signs of a Scam

BIST has created resources which can be printed to act as reminder prompts to help you SPOT & STOP Financial Abuse & Scams.

Download them by clicking on the links below or contact the BIST Office to order free copies:

We have also made available a series of downloadable PDFs on the following topics:

• Internet Safety - The Dos for Best Practices

• Grandparent/Emergency Extortion & Service Scams

Funded by: